Understanding Second Trust Deeds with Help from a Mortgage Broker Glendale CA

Discover Exactly How a Home Mortgage Broker Can Facilitate Your Second Depend On Action Funding

Securing 2nd count on deed funding can be a complicated venture, requiring both critical understanding and market knowledge. A home mortgage broker functions as a beneficial ally in this procedure, leveraging their proficiency to connect the space in between consumers and loan providers. By assessing your financial profile and straightening it with appropriate borrowing alternatives, they ensure that the path to funding is both efficient and compliant with regulatory standards. However what special benefits do brokers supply, and exactly how can they transform your funding trip right into a seamless experience? Reveal the critical function they play in enhancing your monetary outcomes.

Comprehending Second Depend On Deeds

When it pertains to actual estate funding, a 2nd depend on act works as an essential tool for customers looking for extra funds while preserving their existing home loan. Basically, it represents a secondary loan secured versus the customer's building, subordinated to the primary home mortgage. This economic device is especially beneficial for those needing to accessibility equity without re-financing their first home loan, which could have desirable terms or sustain high early repayment charges.

In technique, a 2nd trust act entails the customer vowing their building as security, simply as they performed with their main mortgage. However, it features greater rate of interest prices due to the raised danger for loan providers; they support the initial mortgage in case power structure ought to repossession happen. Despite this, second trust fund actions supply a flexible choice for home owners wanting to fund home renovations, consolidate financial obligation, or cover significant expenses.

Debtors should work out due diligence when considering this alternative, assessing their economic ability to manage additional financial debt (VA Home Loans). Understanding the ramifications of the financing's terms, such as passion rates, payment timetables, and lender costs, is vital. It guarantees debtors make educated decisions that align with their broader financial approach

Role of a Home Mortgage Broker

A mortgage broker plays an essential function in browsing the intricacies of second count on deed funding. Acting as an intermediary between lenders and customers, a broker improves the typically intricate procedure associated with safeguarding a 2nd depend on action. They have the proficiency to analyze a borrower's economic circumstance and recognize appropriate loaning alternatives, ensuring compatibility with specific monetary objectives and restraints.

The home loan broker's duties include reviewing a broad variety of car loan products from various loan providers. This allows them to supply tailored advice and existing alternatives that straighten with the debtor's special requirements. By leveraging their market relationships, brokers can negotiate favorable terms and affordable rate of interest in behalf of the consumer. This arrangement power is important in the largely unregulated landscape of 2nd count on acts, where terms can differ substantially.

Advantages of Using a Broker

Making use of a mortgage broker for 2nd count on deed funding often supplies considerable advantages to consumers. One key advantage is access to a broad network click to investigate of loan providers, which enhances the likelihood of securing beneficial terms. Home loan brokers have market expertise and partnerships with different banks, allowing them to identify the most appropriate choices tailored to individual requirements. This access can be especially helpful for debtors with one-of-a-kind economic circumstances or those looking for affordable passion rates.

In enhancement to providing access to a wider variety of lending institutions, brokers save consumers considerable time and effort. They handle much of the research, from researching possible lenders to assembling essential documentation, thus enhancing the process. This efficiency enables customers to concentrate on various other concerns while making sure that their financing requirements are being attended to by an expert.

Moreover, home loan brokers provide individualized support throughout the funding that site journey. They possess thorough understanding of market trends and can give useful understandings, aiding customers make informed decisions. Brokers additionally act as middlemans, working out terms and conditions on part of their clients to safeguard optimum funding arrangements. Generally, involving a home mortgage broker can simplify the facility landscape of 2nd depend on deed financing, providing substantial benefits to debtors.

Browsing the Application Refine

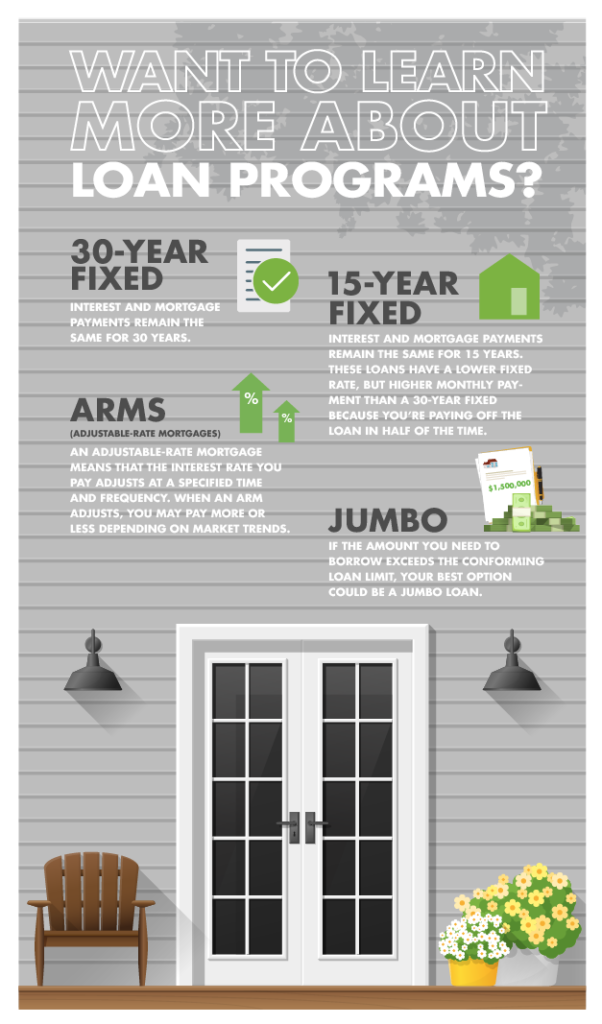

Navigating the application procedure for second depend on deed financing needs mindful focus to information and a strategic method. As a debtor, comprehending the subtleties of this process is essential for securing beneficial terms. Gather all required paperwork, including proof of revenue, credit scores background, and possession details. jumbo loan. This info will be pivotal in presenting a solid application.

Next, assess your economic goals to identify how the second count on deed straightens with your wider financial method. It is vital to clearly verbalize these goals to your mortgage broker, as they will certainly tailor their advice accordingly. A well-prepared application not only demonstrates integrity however also simplifies the approval procedure.

Lastly, stay positive throughout the procedure. Promptly reply to any type of requests for extra details from your broker or loan provider to preserve momentum. This diligence can dramatically affect the rate and success of your financing approval.

Tips for Selecting the Right Broker

Picking the right mortgage broker is similar to finding the best overview through an intricate monetary landscape. The broker you select will play an essential duty click reference in safeguarding positive terms for your second depend on deed funding. To guarantee you make an educated decision, think about these vital tips.

First, confirm the broker's qualifications and experience. A seasoned broker with a proven performance history in second count on actions can give very useful insights and proficiency. Check their licensing and any kind of affiliations with respectable market companies, which typically suggest a commitment to expert criteria.

Following, analyze their interaction skills and responsiveness. A great broker must be conveniently offered to respond to concerns and supply updates. Open and clear communication is crucial in navigating the complex information of real estate funding.

Verdict

Making use of a mortgage broker for second depend on deed funding offers countless advantages, including structured procedures, accessibility to a vast network of lenders, and the settlement of affordable interest prices. With know-how in assessing economic circumstances and guaranteeing regulatory compliance, brokers enhance the probability of safeguarding positive car loan terms. Their participation reduces the intricacy and time investment for debtors, making them a very useful source in accomplishing economic purposes associated to 2nd trust acts.

A mortgage broker plays an essential duty in navigating the intricacies of 2nd depend on deed funding. Acting as a liaison in between lending institutions and borrowers, a broker enhances the typically intricate process included in securing a 2nd depend on action.Making use of a home loan broker for 2nd trust deed funding often supplies substantial benefits to consumers. Overall, engaging a mortgage broker can simplify the complex landscape of 2nd count on deed financing, delivering concrete advantages to consumers.

Making use of a home loan broker for 2nd trust deed funding offers many advantages, consisting of structured processes, accessibility to a broad network of lending institutions, and the negotiation of affordable passion rates.